texas estate tax exemption

All residence homestead owners are allowed a 40000 residence homestead exemption from their homes value for school district taxes. In Texas the federal estate tax limits apply.

Texas Estate Tax Everything You Need To Know Smartasset

If you own a ranch and you are age 65 or older you qualify for this exemption as long as you live in a house on the property.

. Every property should pay its fair share. Through nearly 20 years of law practice15 of which have been focused on the representation of tax-exempt organizationsthis writer has been involved in numerous seemingly simpleand some cutting edgeapplications for exemption from Texas property taxes for religious organizations. B Land owned by the Permanent University Fund is taxable for county purposes.

Property taxes pay for schools roads police and firemen. The value of your property is the basis of the property taxes you pay. There is no state property tax.

Seniors older than 65 or disabled residents. It is also important to remember that Texass threshold is higher than. Property tax brings in the most money of all taxes available to local governments to pay for schools roads police and firemen emergency response services libraries parks and other services provided by local.

If a county collects a special tax for farm-to-market roads or flood control a residence homestead owner is allowed a 3000 exemption for this tax. The taxing unit must decide before July 1 of the tax year to offer this exemption. Property tax in Texas is a locally assessed and locally administered tax.

Any estate that exceeds these thresholds is subject to the federal estate-tax of 40. EXEMPTIONS FOR ATVS AND OFF-ROAD VEHICLES. This percentage exemption is added to any other home exemption for which an owner qualifies.

In 2018 the thresholds for a single persons Texas estate tax were estimated to be 58 million and 112 million for a married couple. Texas has no income taxes but it levies a franchise tax of 0375 on wholesalers and retailers. Department of Veterans Affairs.

Any taxing unit may offer an additional exemption amount of at least 3000 for taxpayers age 65 or older andor disabled. The Estate Tax is a tax on your right to transfer property at your death. The Texas Constitution uses these five rules for property taxes.

A homestead valued at 200000 with a 20 exemption 40000 means you pay property taxes as if your home were valued at 160000. Once you obtain an over-65 or disabled exemption your. Other Property Tax Exemptions in Texas.

Fisher Investments has 40 years of helping thousands of investors and their families. Property tax brings in the most money of all taxes available to local taxing units. For questions about property taxes and ad valorem taxes call our Property Tax Assistance Division at.

Eligible seniors will get a 10000 exemption for school district property taxes. Property tax in Texas is locally assessed and locally admin-istered. If you have questions or need information on applying for an exemption from the Texas franchise tax sales tax or hotel occupancy tax please call 800-252-5555.

Property Tax Exemptions 1. Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. There is no state property tax.

Disabled Veteran Exemption Tax Code Section 1122 provides partial exemptions for any property owned by disabled veterans and surviving spouses and children of deceased disabled veterans and Tax Code Section 11132 provides a partial exemption for residence homesteads donated to disabled veterans by charitable organizations that also extends to surviving. Ad TX Comptroller 12-302 More Fillable Forms Register and Subscribe Now. Find out who qualifies.

The Breakdown of Taxes in Texas. Death taxes consisting of inheritance and estate taxes are also non-existent. Ad Texas Tax Exemption Form.

The exemption will be added to the existing 25000 homestead exemption. This exemption carries over to spouses of deceased property owners as long as the property owner was at least 65 and the spouse is at least 55. A Except as provided by Subsections b and c of this section property owned by this state or a political subdivision of this state is exempt from taxation if the property is used for public purposes.

Texas has several exemptions from local property tax for which taxpayers may be eligible. SENIOR TAX EXEMPTION. How much you save with the home stead exemption depends on the exemption amounts and tax levels adopted by your city county and other local governments.

The primary residence of the applicant. It consists of an accounting of everything you own or have certain interests in at the date of death Refer to Form 706 PDF. Department of Veterans Affairs due to a 100 percent disability rating or determination of individual unemployability by the US.

Tax Code Section 11131 provides an exemption of the total appraised value of the residence homestead of Texas veterans awarded 100 percent compensation from the US. According to Tax Code Section 1127 you may qualify for a Texas property tax exemption if you have a solar or wind-powered energy device installed on your property. If the county grants an.

Optional age 65 or older or disabled exemptions. The fair market value of these items is used not necessarily what you paid for them or what their values were when you acquired them. Taxation has to be equal and uniform.

Although they are not common there are a few other Texas property tax exemptions that might apply to your situation. This rate can go up to 075 for non-exempt businesses. Texas repealed its inheritance tax in 2015 and has no estate taxes either.

Texas Homestead Tax Exemption Cedar Park Texas Living

Estate Tax Planning In Texas The Law Offices Of Kyle Robbins

Qualifying Trusts For Property Tax Homestead Exemption Sprouse Shrader Smith

Is There An Inheritance Tax In Texas

Texas Estate Tax Everything You Need To Know Smartasset

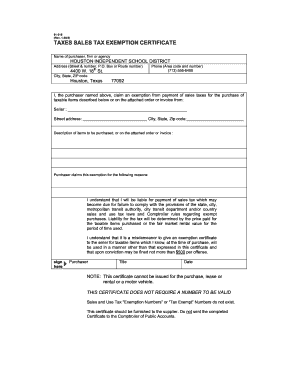

Texas Tax Exempt Certificate Fill And Sign Printable Template Online Us Legal Forms

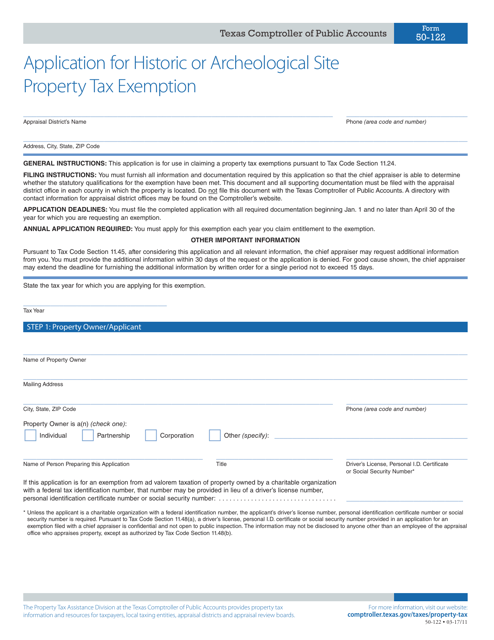

Form 50 122 Download Fillable Pdf Or Fill Online Application For Historic Or Archeological Site Property Tax Exemption Texas Templateroller

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Tx Comptroller 01 315 1991 2022 Fill Out Tax Template Online Us Legal Forms

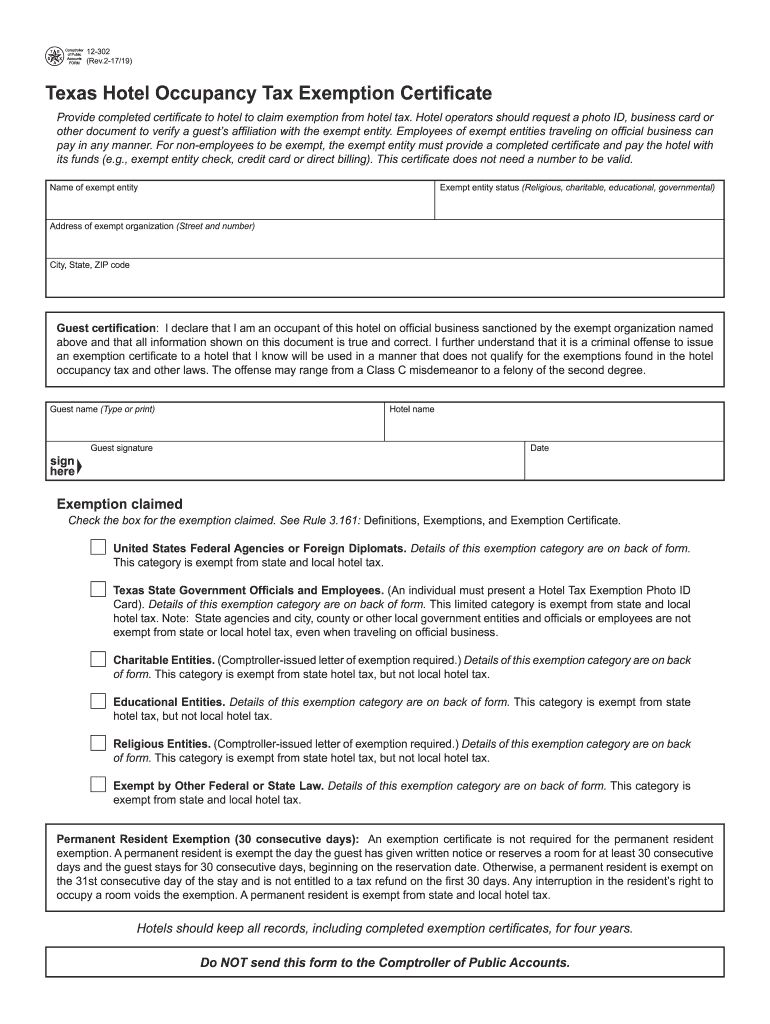

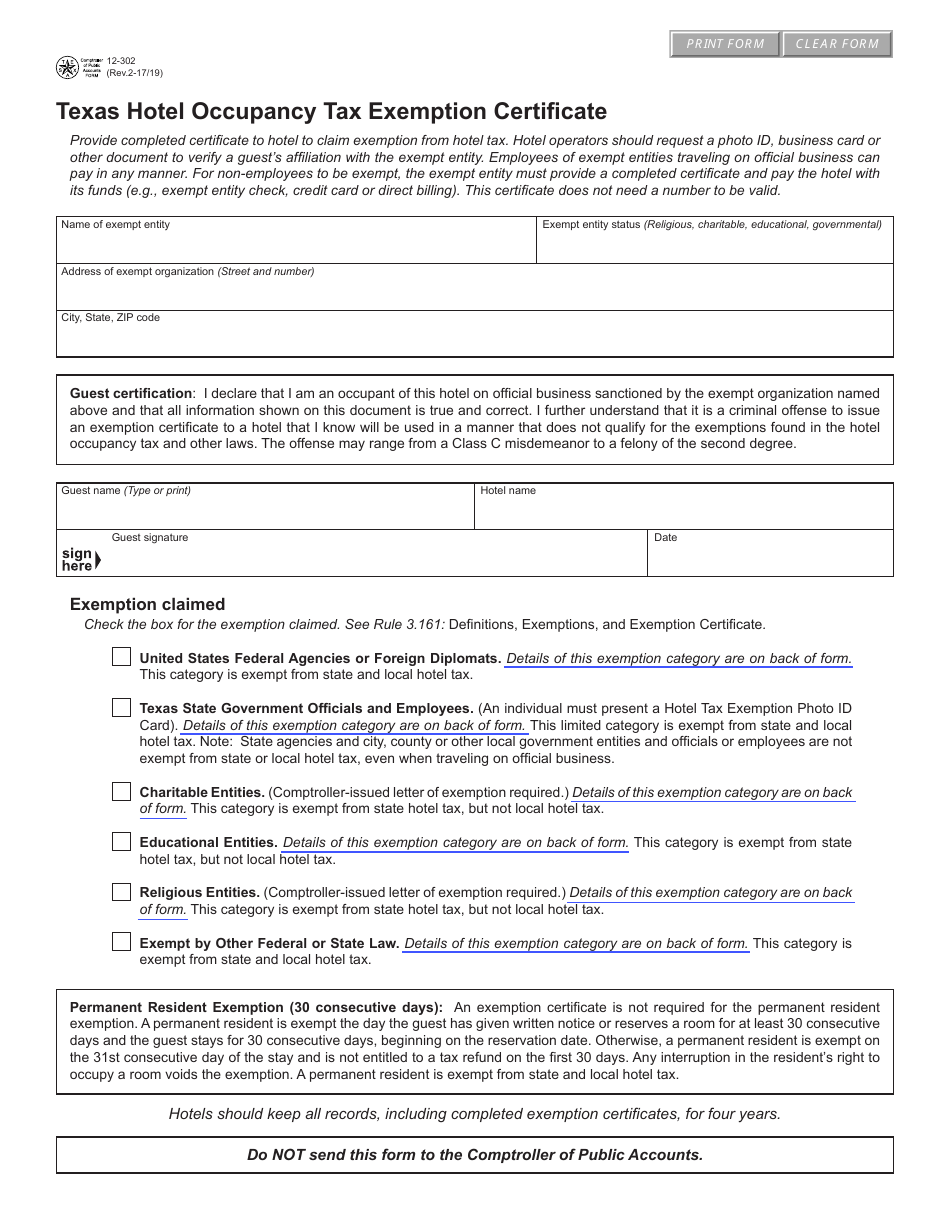

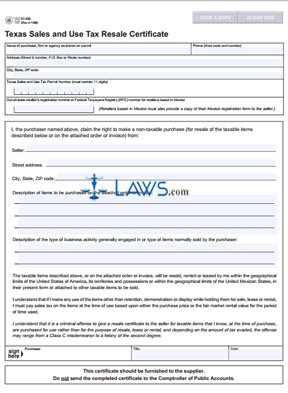

Tx Comptroller 12 302 2017 2022 Fill Out Tax Template Online Us Legal Forms

Over 65 Property Tax Exemption In Texas

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption

Form 12 302 Download Fillable Pdf Or Fill Online Hotel Occupancy Tax Exemption Certificate Texas Templateroller

Title Tip Another Legislative Update For Texas Homeowners Candysdirt Com

Texas Tax Exempt Form Fill Out And Sign Printable Pdf Template Signnow

Free Form 01 339 Texas Sales And Use Tax Exemption Certification Free Legal Forms Laws Com

Texas Estate Tax Everything You Need To Know Smartasset